Picture this: You’re looking at your profit and loss statement showing a healthy £40,000 profit, but when you check your bank account, you’re scraping together funds to pay the rent. How is this possible? Welcome to the fascinating world of accounting methods.

The Two Accounting Methods

Cash Accounting: The “Show Me The Money” Method

Cash accounting is beautifully simple – it’s essentially your bank statement dressed up in business attire. Here’s how it works:

Revenue Recognition:

- Money is recorded only when it physically enters your bank account

- Invoice sent in March but paid in May? It’s May revenue

- Perfect for businesses with immediate payment cycles

Expense Recognition:

- Costs are recorded when you actually pay them

- Received goods in January but paid in February? It’s February expense

- Brilliant for understanding your actual cash position

Real-World Example: Sarah’s consultancy invoices £15,000 in December but receives payment in January. Under cash accounting, this appears as January revenue, even though the work was completed the previous year.

Accrual Accounting: The “Economic Reality” Method

Accrual accounting focuses on when transactions actually occur economically, regardless of cash movement:

Revenue Recognition:

- Income recorded when earned (typically when invoice is raised)

- Reflects the true timing of your business activities

- Shows what you’ve actually achieved in each period

Expense Recognition:

- Costs recorded when incurred (when goods/services are received)

- Matches expenses with the revenues they help generate

- Provides accurate profitability analysis

Real-World Example: Using Sarah’s scenario again – the £15,000 would appear as December revenue under accrual accounting, matching when the work was actually delivered.

The Profit & Loss Impact: Where Things Get Interesting

Scenario: Tech Startup Example

Let me paint you a picture with numbers:

December Activity:

- Invoiced clients: £25,000

- Received payments: £15,000 (from November invoices)

- Purchased equipment: £8,000 (paid immediately)

- Office rent: £2,000 (for December, paid in January)

Cash Accounting P&L:

- Revenue: £15,000 (what actually came in)

- Expenses: £8,000 (what actually went out)

- Profit: £7,000

Accrual Accounting P&L:

- Revenue: £25,000 (what was earned)

- Expenses: £10,000 (£8,000 equipment + £2,000 rent incurred)

- Profit: £15,000

Same month, completely different story!

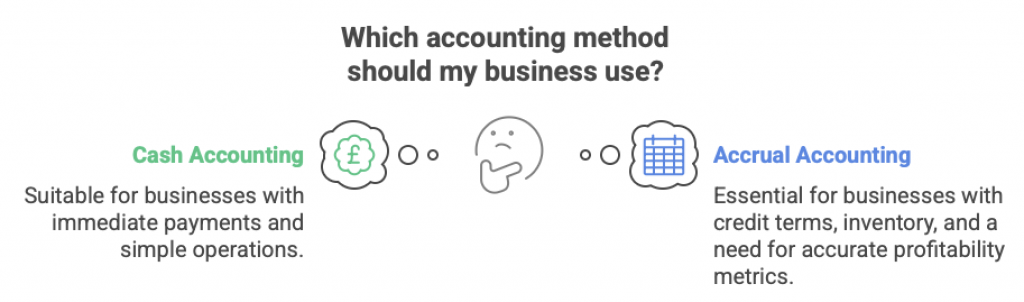

Which Method Suits Your Business?

Cash Accounting Works Brilliantly For:

- Service businesses with immediate payment

- Retail with predominantly cash/card sales

- Simple operations without complex timing issues

Accrual Accounting Is Essential For:

- B2B companies with 30+ day payment terms

- Businesses with significant stock/inventory

- Business owners wanting to understand true profitability

- Growing businesses needing accurate performance metrics

The Hidden Dangers

Cash Accounting Pitfalls:

- Can mask declining profitability if customers pay slower

- Seasonal businesses might show misleading patterns

- Growth planning becomes challenging

Accrual Accounting Challenges:

- Profit without cash can create dangerous situations

- More complex bookkeeping requirements

- Requires understanding of timing differences

Making The Right Choice

The decision isn’t just about compliance – it’s about running your business effectively. I’ve seen brilliant businesses struggle because they didn’t understand their chosen method’s implications.

My Recommendation Process:

- Assess your payment cycles – How quickly do customers pay?

- Consider your growth plans – Will you need investor-ready accounts?

- Evaluate complexity – Can you handle accrual’s requirements?

- Think about decision-making – What information helps you most?

Although for self-employed businesses or partnerships without corporate partners can switch methods, but consistency is key for meaningful comparisons.

The goal isn’t just compliance – it’s clarity. Your accounting method should illuminate your business performance, not obscure it.

Need help choosing the right accounting method for your business? Let’s have a conversation about what works best for your specific situation.