As a chartered accountant serving small business owners across England, I’ve discovered a troubling paradox: the hardest working entrepreneurs often struggle the most with personal wealth accumulation. They feel constantly “firefighting,” dealing with immediate problems whilst rarely having time for long-term planning.

The Brutal Truth About Poverty: It’s Not a Character Flaw, It’s a System Trap

The 2019 Nobel Prize winners in Economics—Banerjee, Duflo, and Kremer—spent 15 years researching across 18 countries and uncovered a shocking truth: poverty isn’t caused by laziness or lack of ability, but by psychological and systemic traps.1

Revolutionary Discoveries

1. Scarcity Mindset Hijacks Your Brain

When people are struggling to make ends meet, their brain’s cognitive resources become overwhelmed by immediate problems, making long-term thinking impossible. It’s like running a computer with insufficient memory—everything slows down.2

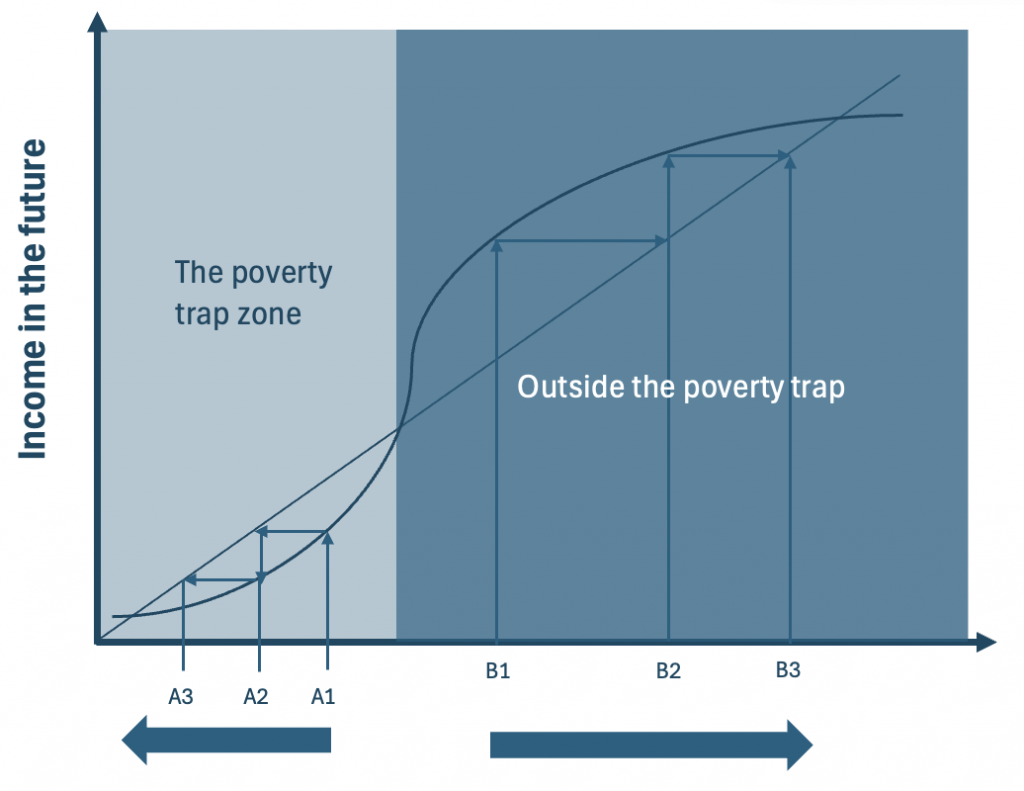

2. The S-Curve Wealth Trap

Research revealed that wealth growth follows an S-curve pattern:3

- Below a critical threshold: spiral into deeper poverty (poverty equilibrium)

- Above the threshold: accelerating wealth growth (wealth equilibrium)

- The key is crossing that critical threshold

3. Why Education is the Ultimate Investment

Education is one of the most powerful tools for escaping poverty. Studies show that investing in education leads to better jobs, higher income, improved health, and even longer life expectancy.4

For example:

- Every additional year of schooling can raise earnings by about 10% and has a ripple effect on health and community well-being.

- Education empowers people to innovate, adapt, and create opportunities for themselves and their families.

While you might see claims about precise “years of benefit” from every pound invested, the real takeaway is this: education pays off for decades, both for individuals and for society.

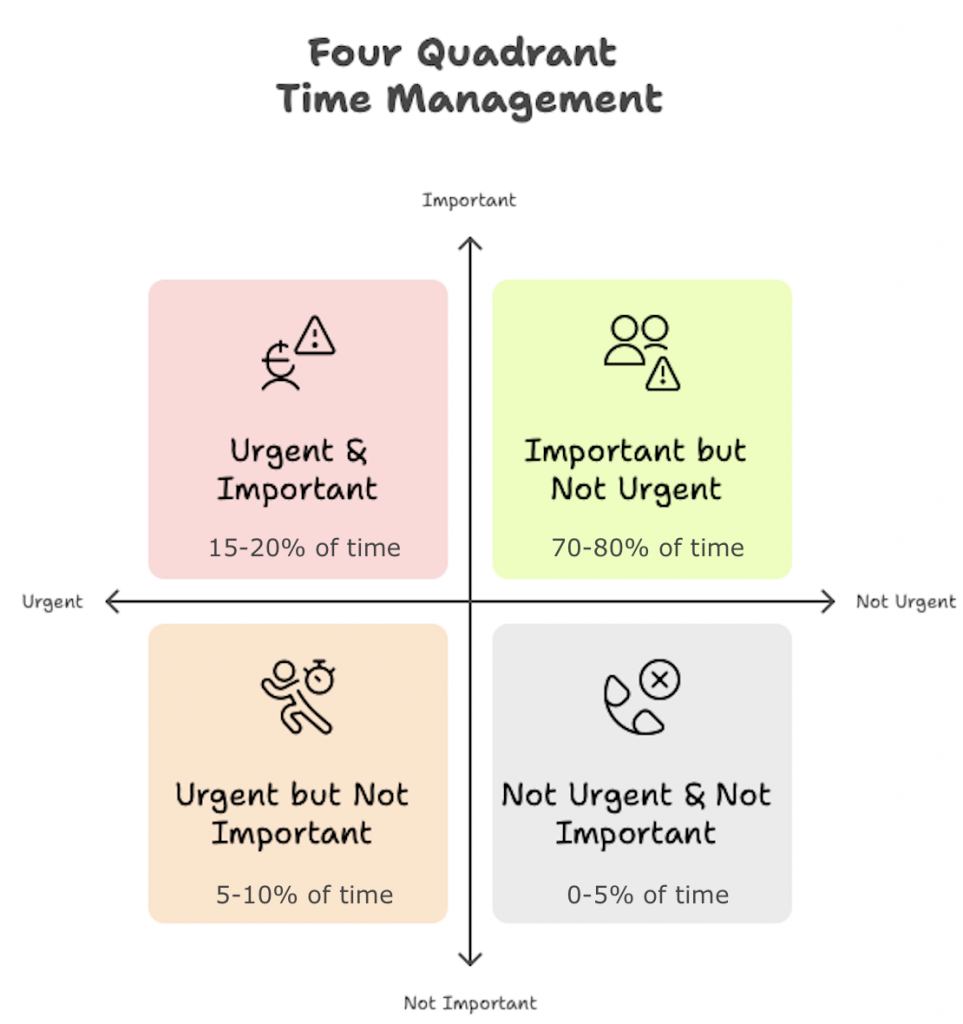

The Four Quadrant Wealth Strategy: From Time Management to Wealth Mastery

Based on these research insights, I’ve upgraded the classic four-quadrant time management approach into a wealth management strategy:

🚨 Quadrant 1: Urgent & Important (15-20% of time)

Typical scenarios:

- Client financial crises

- Tax filing deadlines

- Critical business decisions

- Family emergencies

Management strategies:

- Build early warning systems to identify risks

- Create standardised emergency procedures

- Reduce these situations through Quadrant 2 investments

🎯 Quadrant 2: Important but Not Urgent (70-80% of time) ⭐

This is the wealth growth battleground:

Skills Development Investment:

- Continuous professional skill upgrades

- Business thinking and financial knowledge

- Communication and leadership abilities

- Digital and automation skills

Health and Risk Management:

- Regular health checks and preventative investments

- Comprehensive insurance planning

- Emergency fund building (3-6 months expenses)

Network Building:

- Mentor and advisor relationships

- Industry expert networks

- Client relationship deepening

- Strategic partnership expansion

Passive Income Construction:

- Investment portfolio building

- Knowledge product development

- Consultancy service systematisation

- Business process automation

⚡ Quadrant 3: Urgent but Not Important (5-10% of time)

Common traps:

- Irrelevant emails and meetings

- Administrative busywork

- Reactive social media responses

Optimisation strategies:

- Batch process similar tasks

- Delegate and outsource

- Apply automation tools

- Set boundaries and learn to say “no”

❌ Quadrant 4: Not Important & Not Urgent (0-5% of time)

Time killers that must be eliminated:

- Mindless social media scrolling

- Excessive entertainment consumption

- Worthless social activities

- Impulse shopping

Implementation Framework: 90-Day Wealth Acceleration Plan

Month 1: Foundation Building

- Complete financial situation analysis

- Purchase essential insurance

- Create learning schedule

Month 2: System Optimisation

- Optimise spending structure

- Establish health management system

- Expand professional network

Month 3: Long-term Positioning

- Create 3-5 year wealth plan

- Develop passive income sources

- Establish personal brand

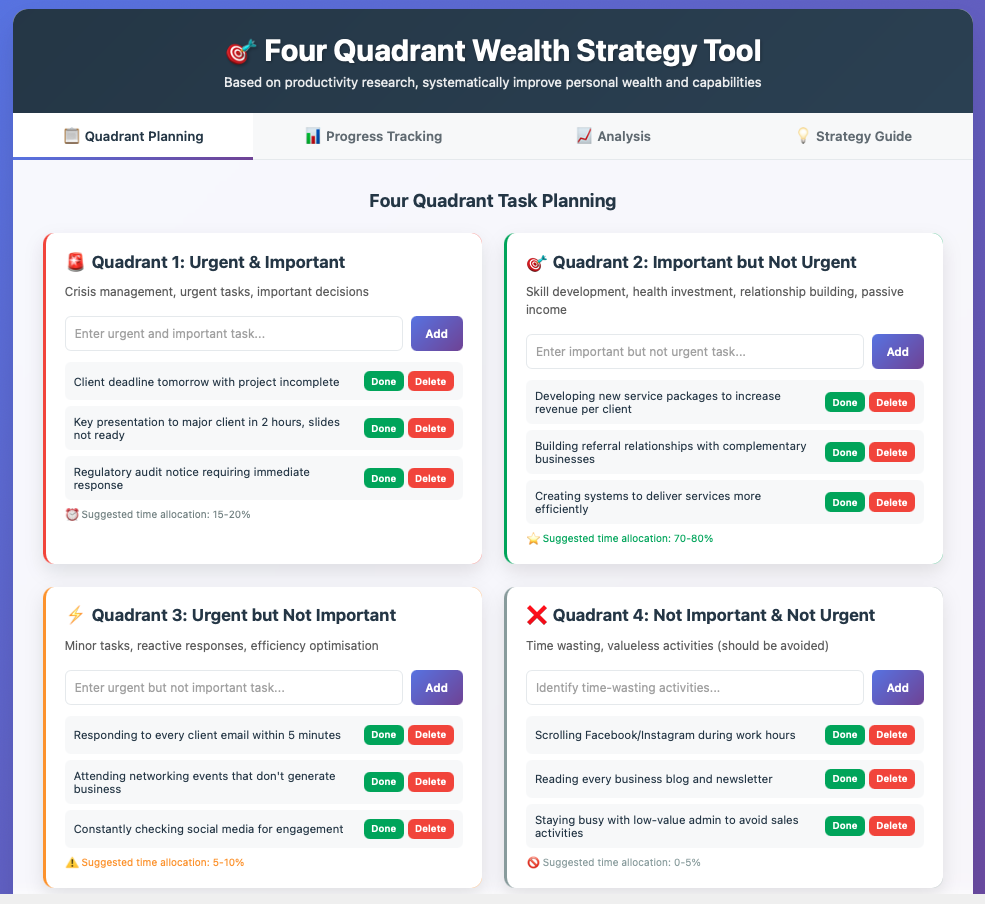

Free Tool: Four Quadrant Wealth Strategy Planner

To help more small business owners systematically apply this strategy, I’ve developed a free interactive planning tool. This resource includes:

✅ Four-quadrant task planning system

✅ Time allocation optimisation recommendations

✅ Progress tracking and data analysis

✅ Personalised development suggestions

✅ Strategy guides and implementation examples

Access it free here.

Conclusion

Wealth freedom isn’t achieved overnight—it’s built through systematic strategies and consistent execution. The key is escaping the “busy trap” and investing more time and energy in genuine long-term value creation.

As your accountant, I believe everyone has the potential to achieve financial freedom. What matters is having the right strategy, appropriate tools, and the determination to take consistent action.